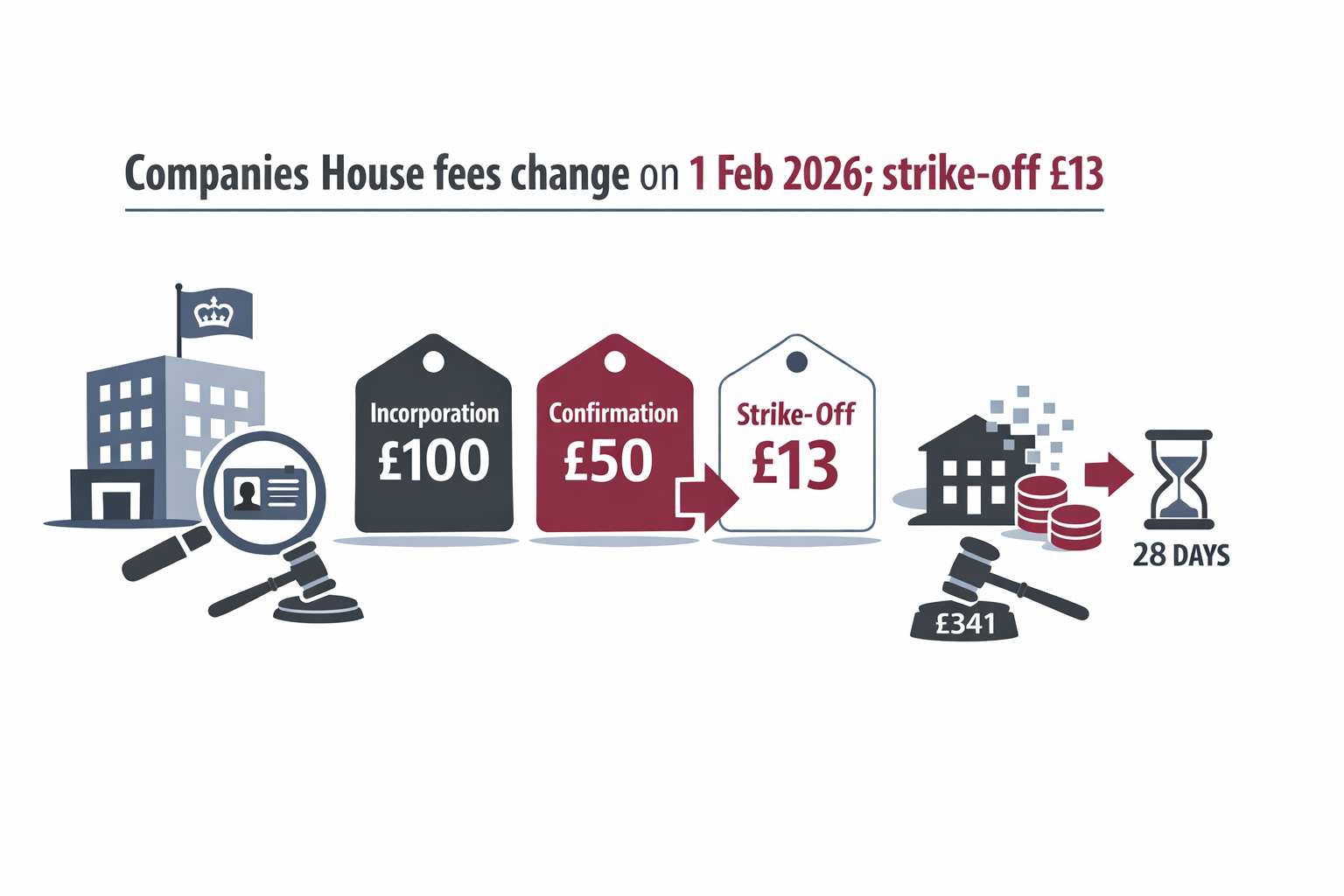

Companies House has confirmed another reset of statutory fees from 1 February 2026. Digital incorporation will rise to £100, the digital confirmation statement to £50, while the digital voluntary strike‑off drops to £13. The notice was published on 30 October 2025 and updated on 5 November 2025, with a detailed schedule available on the official campaign site.

This is the second shift in under two years. Fees were increased on 1 May 2024, taking digital incorporation from £12 to £50, the digital confirmation statement from £13 to £34, and the online voluntary strike‑off to £33. Companies House maintains that its charges are set on a cost‑recovery basis.

One change stands out: making it cheaper to dissolve than to maintain. The digital strike‑off will fall from £33 to £13, with paper at £18. By contrast, undoing a mistake remains onerous. Administrative restoration currently costs £468 and, even after February 2026, will still be £341. And if directors initiated the strike‑off, administrative restoration is not available - creditors must seek a court order. For stakeholders facing evasive dissolutions, the price signal is plain.

Creditors should treat Gazette strike‑off notices as time‑critical. An objection, if accepted, pauses dissolution for six months; if action is still needed, it must be renewed before the pause expires or the company can be removed. Companies House’s own service sets out the evidence standards and confirms that some notices run on a 28‑day timetable rather than two months.

Companies House argues the fee changes support stronger gatekeeping powers introduced under the Economic Crime and Corporate Transparency Act 2023. Since 4 March 2024 the registrar can query filings before or after they hit the register, demand supporting evidence, remove false information, tighten address rules and share data with law enforcement. The intent is clear; the question is consistency and follow‑through.

Mandatory identity checks arrive ahead of the fee shift. From Tuesday 18 November 2025, new directors must verify their identities to incorporate or be appointed; existing directors confirm they’re verified at their next confirmation statement during a 12‑month transition. People with significant control have defined 14‑day windows, depending on whether they are also directors and when their confirmation statement falls. Verification is via GOV.UK One Login or an Authorised Corporate Service Provider.

Fee income will continue to underwrite investigations. Companies House states that its receipts fund The Insolvency Service’s company investigation and enforcement activity. That funding stream is visible in the Insolvency Service’s plan, which records £55.8m from Companies House in 2024/25 and £60.5m in 2025/26, and in Companies House’s own accounts, which show a marked uplift in spend on ECCT‑related investigation and enforcement undertaken by the Insolvency Service.

The numbers on the register underline the stakes. In the financial year ending March 2025 there were 726,735 dissolutions, up 9.6% year‑on‑year. As volumes rise, the gap between a £13 application to dissolve and the cost and complexity of reversing that removal becomes a live risk transfer from dissolving directors to unpaid creditors and employees.

Performance will be scrutinised. Earlier this year, press reporting highlighted that only a small fraction of issued civil penalties had been collected to date, raising fair questions about bite as well as bark. With identity checks becoming compulsory from 18 November 2025, the regulator will have fewer excuses for weak follow‑through.

For practitioners and lenders, several other 2026 price points are notable: registering a charge digitally will be £14; same‑day change of name £85; and agent authorisation will require an ACSP registration fee of £63. These are operational costs that need budgeting alongside more frequent registrar queries and identity checks.

Property‑facing groups should note changes to the Register of Overseas Entities: digital registration will be £250, the annual update £134 and an application for removal £301. These adjustments sit within the same cost‑recovery narrative and will matter for portfolio hygiene and transactional timetables.

Companies House says its fees ‘remain low by international standards’, but its latest annual report also records income more than doubling to £220.3m in 2024/25 and a year‑end surplus driven by delayed identity‑verification running costs and slower recruitment. If higher fees are now a permanent feature, creditors and directors deserve transparent metrics showing how that cash converts into timely strike‑off objections, effective identity checks and joined‑up Insolvency Service enforcement.