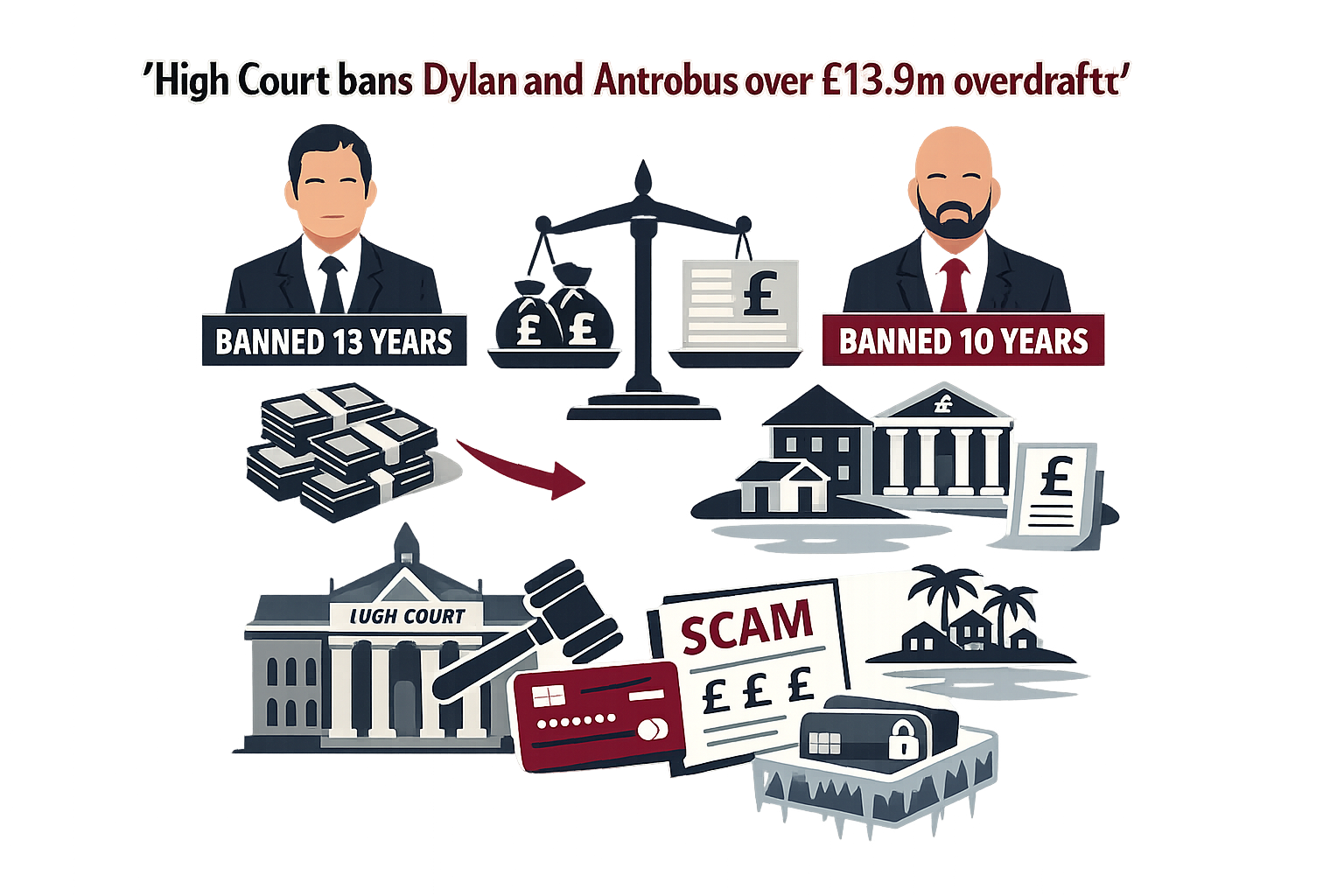

Two former business associates from Salford have been barred from running companies for a combined 23 years after a High Court hearing on 4 December 2025. The Insolvency Service says Scott Dylan, 41, was disqualified for 13 years and David Antrobus, 39, for 10, following a £13.9m flow of funds through unauthorised overdrafts that left insolvencies exceeding £52m.

The bans take effect on 25 December 2025 and prohibit both men from forming, promoting or managing a company without court permission. According to the Insolvency Service, the judge said the conduct was ‘little short of a scam’ and found no legitimate purpose for the removal of funds.

In March and April 2021, Antrobus signed Barclays bank applications in his capacity as the registered director of Oldcoft Ltd (12077796) and Old3 Ltd (11169385), naming Dylan as the primary contact. The Insolvency Service records that the companies were known at the time as FT (OPS) Limited and Fresh Thinking Group Limited.

Three Barclays accounts were opened in April and May 2021, including a euro account for Oldcoft. From mid‑July to late September 2021, more than £13.9m was credited to Oldcoft’s current account from ten connected companies, all funded via unarranged overdrafts. Over the same period, payments exceeding £11.7m were made out.

The payment trail cited by the Insolvency Service shows Dylan personally received £1.675m; more than £7.4m moved to Old3’s account; and at least £1.545m went to other connected entities. In August 2021 the Oldcoft euro account ran an unarranged overdraft to fund 37 transfers totalling €1.795m to a family member. Liquidators reported finding no evidence to support Dylan’s explanation that this related to a hotel purchase in Turkey.

Barclays secured freezing orders on 24 September 2021 and sought explanations and, within a fortnight, repayment. By November 2021 the ten feeder companies had entered provisional liquidation. Oldcoft was wound up in January 2022 with an estimated £44m deficiency, including £13.7m owed to Barclays, while Old3 entered administration in April 2022 with an estimated £8.2m shortfall.

Despite the freezes, the pair transferred an entire group of companies to two British Virgin Islands entities without informing Barclays. The High Court later found them in contempt of court. In October 2024, Dylan received a 22‑month sentence for contempt; Antrobus received the same term in his absence, with a warrant of committal issued for his arrest.

The Insolvency Service describes Dylan as the driving force. It also notes he should not have been acting as a director in 2021, having given an undertaking to the court in September 2019 while separate proceedings over SDRW Limited (08600217) continued. Those concluded in September 2025 with an eight‑year disqualification after findings that he acted as a director while bankrupt between July 2013 and July 2015.

For creditors, the arithmetic is stark: Oldcoft’s c.£44m deficit and Old3’s c.£8.2m deficiency point to limited recoveries absent successful tracing and clawback. Barclays appears as a principal claimant, but unsecured creditors face long lead times and cross‑border enforcement hurdles before any distribution.

Liquidators are likely to consider misfeasance and breach‑of‑duty claims, applications to set aside transactions defrauding creditors, and tracing of onward payments. Cooperation requests to counterparts in the British Virgin Islands and Turkey may be required. The practical test is whether meaningful value can be located and recovered for the estates.

The banking controls warrant scrutiny. Allowing multi‑million‑pound unarranged overdrafts across current and euro accounts indicates weaknesses in first‑line checks and escalation. Barclays has since obtained court orders and demanded repayment; shareholders and regulators will ask how credit limits were exceeded and whether internal alerts were pursued promptly.

Antrobus, who failed to maintain and deliver Oldcoft’s accounting records to the liquidator according to the Insolvency Service, was declared bankrupt in August 2025. Both men are formerly of Wadlow Close, Salford. From 25 December 2025 they are barred from forming, managing or promoting companies without the court’s permission.

The Insolvency Service’s public interest rationale is clear: to keep proven abusers of company structures away from the controls of corporate accounts. For creditors, the immediate priority is visibility: regular office‑holder updates, clear budgets for investigations, and transparent reporting on any asset recoveries.

This case follows a familiar pattern seen in distressed groups: rapid account opening, heavy use of unarranged overdrafts, swift extraction of funds, and cross‑border transfers, followed by breaches of court orders. Stakeholders will be watching the next steps closely once the bans take effect on Christmas Day.