Northern Ireland’s Department for the Economy has created a charging power for distributing money recovered under compensation orders and undertakings against disqualified directors. The Disqualified Directors Compensation Orders (Fees) Order (Northern Ireland) 2026 was made on 11 February 2026 and will commence the day after it is affirmed by the Assembly. The instrument was sealed by Economy Minister Dr Caoimhe Archibald with Department of Finance concurrence from senior officer Patrick Neeson; the text is published on legislation.gov.uk. Dr Archibald has held the Economy brief since 3 February 2025. (economy-ni.gov.uk)

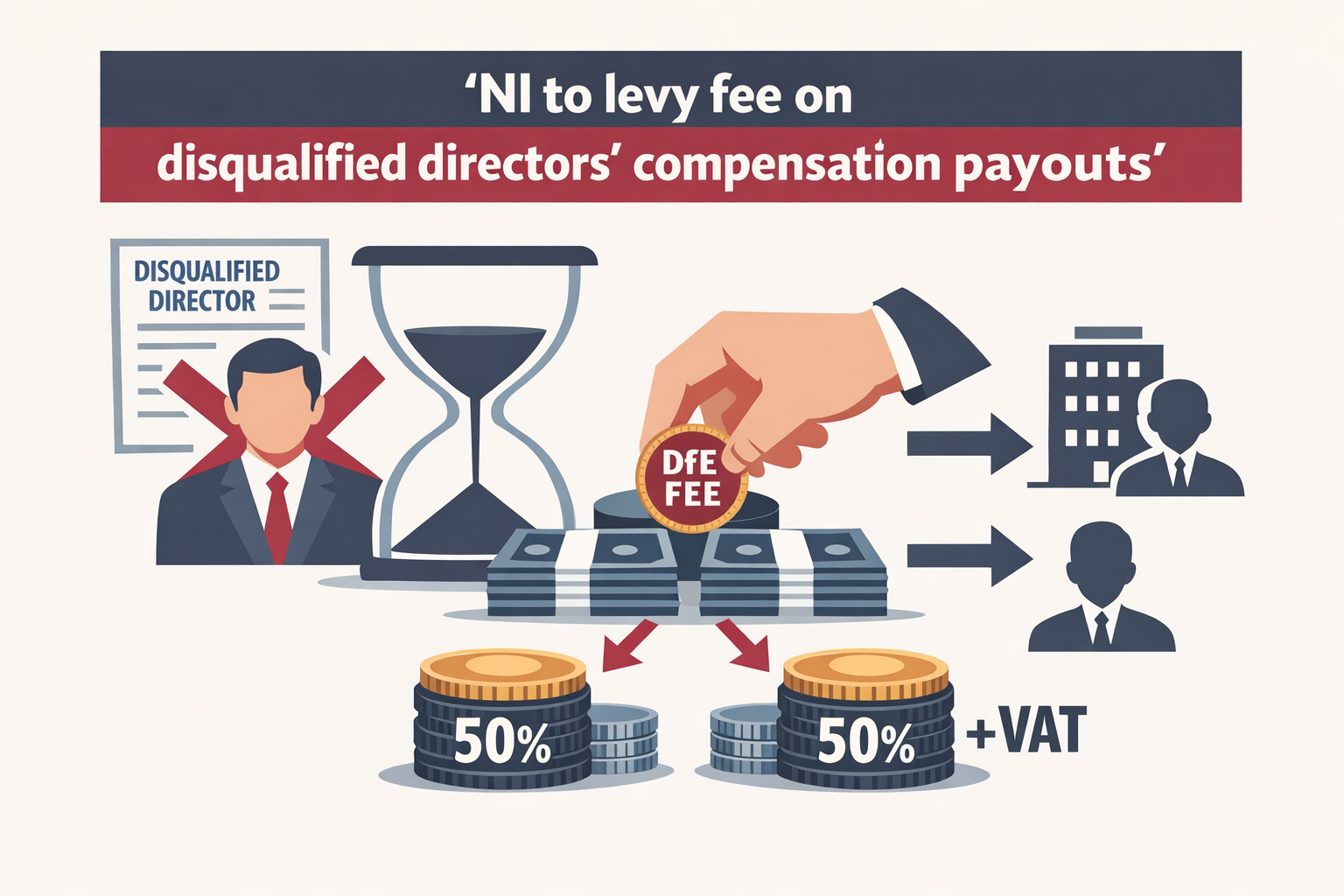

The mechanics matter for recoveries. Before any payment reaches named creditors, the Department will deduct a fee comprising: total time spent by ‘appropriate officials’ on the distribution task multiplied by hourly rates set in the Order’s Schedule, plus ‘necessary disbursements or expenses properly incurred’. That aggregate is then divided equally by the number of creditors specified in the compensation order or undertaking. Where VAT is chargeable, it is added on top. In short: the Department’s costs come off the pot first, and each listed creditor is docked the same share, regardless of claim size.

This equal‑split design deserves scrutiny. In many insolvency outcomes, costs reduce the estate overall and creditors recover pro‑rata to claim value; here, a flat, per‑head deduction risks disproportionately eroding small claims. A trade supplier owed a few hundred pounds or an employee with a modest award could see most or all of their entitlement consumed if the Department’s time and expenses are material and the creditor headcount is low. Creditors will want itemised time records, staff grades applied and a clear VAT position for each case.

The Schedule pegs hourly rates to the Insolvency Service grading structure. That means the ultimate deduction depends on which grades touch the file and for how long, not on how much any individual creditor is due. For transparency, the Department should publish a plain‑English version of the Schedule rates, adopt minimum billing units no larger than six minutes, and commit to issuing a per‑case statement showing time entries, grade, rate, disbursements and VAT charged. Anything less leaves creditors guessing at how much public‑sector overhead has been loaded onto their recovery.

Northern Ireland is not breaking new ground by allowing the distributing authority to levy a fee. England and Wales introduced a parallel regime in 2016, confirming that government may recover distribution costs linked to compensation orders against disqualified directors. That precedent makes it harder to argue the concept is novel-though it does not answer fairness concerns about an equal split between creditors in Northern Ireland. (publications.parliament.uk)

For readers new to this area, compensation orders and undertakings were brought in to make disqualified directors pay for creditor losses arising from unfit conduct. The Insolvency Service guidance explains that compensation can be directed to specific creditors or classes of creditors, or into the insolvent estate, and that applications must be brought within two years of disqualification. That context matters: a Department fee that bites into a hard‑won award is not an abstract levy-it is money that otherwise would go to those creditors. (gov.uk)

Northern Ireland has been building this regime over the past year. Procedural rules for these applications-the Compensation Orders (Disqualified Directors) Proceedings (No. 2) Rules (Northern Ireland) 2025-took effect on 11 July 2025. With the new Fees Order, the final step is deciding how distribution costs are recouped from awards. The Gazette notice and Assembly records confirm that shift in 2025 from concept to procedure. (thegazette.co.uk)

The Order is subject to the Assembly’s affirmative resolution procedure and only starts the day after approval. That matters for timing of deductions on live or imminent cases. Under the affirmative model, a statutory rule cannot come into force until approved-an important check where a Department is both process owner and fee‑taker. Creditors should press MLAs on whether the equal‑share formula is the right balance between administrative cost recovery and fair distribution. (en.wikipedia.org)

What should creditors ask for once this is in force? First, an itemised invoice showing time entries by grade and task, the hourly rate applied from the Schedule, each disbursement with a receipt trail, and the VAT basis. Second, confirmation of the number of named creditors used to split the aggregate fee. Third, a calculation showing each creditor’s net entitlement before and after the deduction. Those basics are essential if the Order is to improve confidence rather than breed dispute.

There are obvious policy fixes the Department and Assembly could consider as the instrument beds in: a de minimis threshold below which deductions are waived for micro‑claims; a cap on the per‑creditor deduction as a percentage of that creditor’s payout; or, more simply, switching from an equal split to a pro‑rata split by claim size. None of these requires abandoning cost recovery-only aligning it with creditor fairness.

Transparency is the make‑or‑break test. The Order routes money through government before it reaches those it is meant to compensate. To avoid conflicts of interest-where the Department both decides the work and bills for it-there should be quarterly reporting to the Economy Committee on hours charged, average deductions per creditor, VAT collected, and complaints or challenges upheld. Freedom of Information requests can and will fill any vacuum.

Bottom line: a fee for administering distributions may be defensible, but the chosen model-equal deductions per listed creditor, plus VAT where applicable-will hit the smallest claimants hardest unless tightly controlled and transparently billed. Creditors, MLAs and the Department should treat the imminent affirmative vote as the moment to lock in those safeguards.