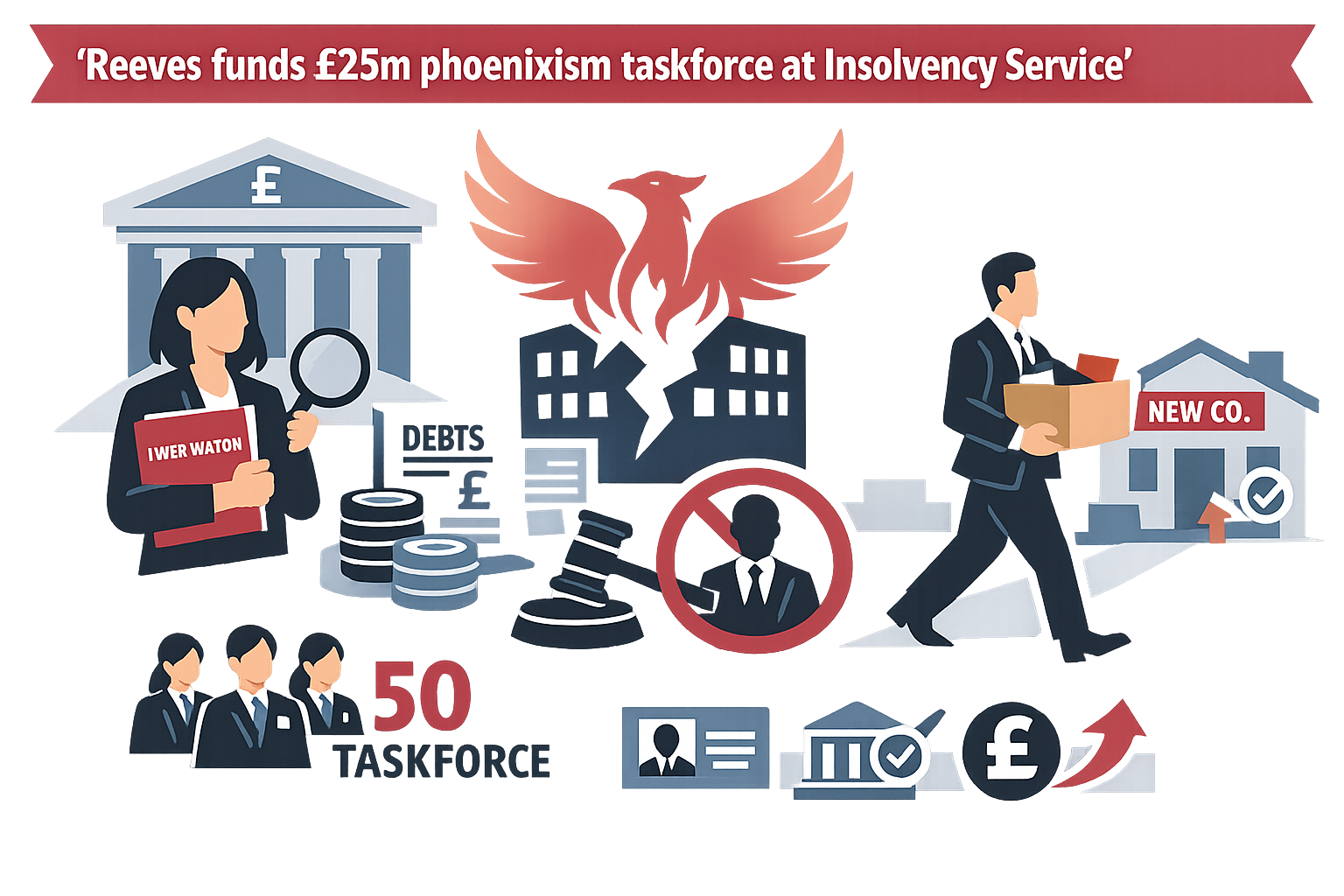

Chancellor Rachel Reeves used today’s Budget to pledge £25 million over five years to the Insolvency Service for an Abusive Phoenixism Taskforce staffed by 50 investigators. The agency welcomed the cash and the stated aim of disqualifying more directors who repeatedly dump liabilities and reappear under a new banner.

Even on day one, the numbers matter. £25 million equates to roughly £5 million a year - enough for a 50‑person team - in an organisation that employed 1,847 staff at 31 March 2025. The taskforce would therefore lift capacity by just under 3%, raising questions about what additional outcomes Whitehall expects to buy with this money.

Scale is the challenge. October 2025 alone saw 2,029 company insolvencies in England and Wales, with creditors’ voluntary liquidations making up 78% of cases - procedures typically initiated by directors who also choose the liquidator. Against volumes at this level, 50 new investigators will need sharp triage and clear targets.

The public cost of phoenixing is not theoretical. HMRC’s latest estimate put tax losses from phoenixing at £836 million in 2022‑23. Yet the National Audit Office reported that, between 2018‑19 and 2023‑24, the Insolvency Service recorded just seven disqualifications categorised specifically as phoenixism - a gulf that demands an explanation beyond warm words.

Dave Magrath, the Service’s Director of Investigation and Enforcement Services, called the funding “welcome” and said it would help stop directors who use insolvency to avoid debts and retain assets, allowing the agency to disqualify more offenders and protect consumers. The statement is noted; creditors will judge the delivery.

What is missing is a performance plan. The Budget announcement sets no target for the number of phoenix‑related cases to be opened, disqualifications to be secured, or compensation orders to be obtained - nor any timescale from referral to sanction. Without measurable goals, the risk is that the taskforce becomes another label for existing workstreams.

The current enforcement profile is still heavily skewed by pandemic loan misconduct. In 2024‑25, the Service disqualified 1,037 directors and completed 169 prosecutions, with 63% of outcomes linked to COVID‑19 scheme abuse; it also wound up 41 companies in the public interest. Phoenix behaviour outside that context requires its own sustained focus.

The agency’s new Investigation and Enforcement Strategy (2026‑31) promises a more assertive role in corporate enforcement using data analytics and closer work with Companies House and HMRC. Yet as the NAO has pointed out, some Companies House reforms - such as full identity verification for directors - are not fully in force pending systems and secondary legislation. Progress depends on those plumbing changes landing.

Funding context matters too. From 2024‑25 the Service began receiving tens of millions via Companies House fees to support corporate investigations, a shift designed to stabilise enforcement resourcing after years of short‑term pots. Against that baseline, an extra £5 million a year is modest unless it is genuinely ring‑fenced for complex phoenix cases.

Most corporate failures are CVLs initiated by directors. That structure can allow phoenix behaviour to be dressed up as routine closure followed by a near‑identical restart, often with the same advisers orbiting the process. The taskforce’s credibility will rest on how quickly it converts IP referrals and data flags into director bans, asset recovery, and, where warranted, criminal action.

On returns to creditors, disqualification alone is not enough. The Service can and should use compensation orders and undertakings alongside bans; in 2024‑25 it obtained 118 such outcomes worth £3.6 million. HMRC also holds a separate power to issue Joint and Several Liability Notices to individuals behind repeated insolvencies and non‑payment. Alignment between these tools will be the real test.

For now, the government’s message couples this measure with a wider marketplace “crackdown” from right‑to‑work checks to counterfeit vapes. That is political packaging. Creditors want something narrower: visible, timely action against directors who dump tax and trade debts, pick over any remaining assets, and start again. We will track the case outcomes the Chancellor’s £25 million actually buys.