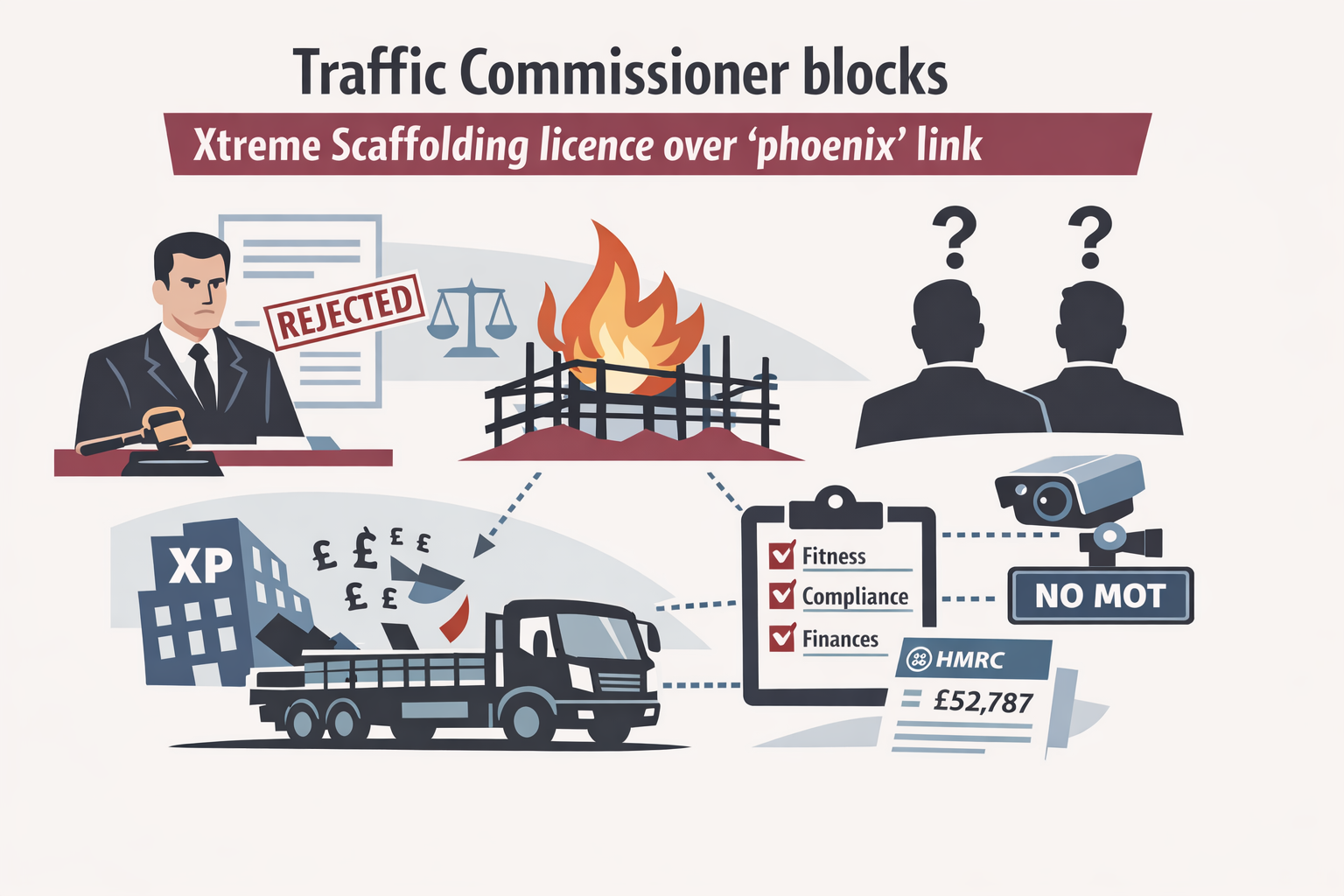

The North West Traffic Commissioner has refused Xtreme Scaffolding Services Ltd’s bid for a restricted operator’s licence (OC2081807), citing a ‘phoenix’ attempt following XP Scaffolding Ltd’s collapse with tax arrears to HMRC.

The case was considered at a public inquiry in Golborne on 22 October 2025. Xtreme Scaffolding did not attend. The written decision, signed by Commissioner David Mullan on 27 October and published on 6 November, formalised the refusal.

Commission officials said the application-covering a single vehicle-failed three statutory tests under the Goods Vehicles (Licensing of Operators) Act 1995: fitness (section 13B), compliance with undertakings (13C), and financial resources (13D).

Directors named on the application are David Barson and Stephen Procter. The decision sets out a long association between the directors and earlier licences, including a previous company of the same name that was dissolved in March 2021 while its licence (OC1072461) was still on the books until termination for non‑payment in August 2022.

The Commissioner linked the new bid to XP Scaffolding Ltd, which entered liquidation on 5 October 2023 owing £120,743, including £52,787 to HMRC and a £45,000 Bounce Back Loan. Two XP vehicles were purchased by Xtreme Scaffolding; the decision labels the new bid a ‘phoenix application’ intended to continue trading without the old debts.

The regulatory file records DVSA evidence of 241 ANPR hits on a former XP vehicle after liquidation and an instance of use without a valid MOT. That pattern, the Commissioner said, went directly to questions of compliance and road safety.

Service of the hearing notice was proved: letters were delivered and signed for ‘Proctor’ [sic], and calls on the day went unanswered. “This is not a business that is actively pursuing its application,” the decision states, declining any adjournment.

On the legal tests, the decision underlines that trust is central to licensing. Failures on fitness, undertakings, and finances require refusal under section 13(5). For restricted licences, officials typically expect evidence of access to funds-£3,100 for the first vehicle-so maintenance is not compromised.

This is not the first time the directors’ arrangements have been examined. A separate public inquiry on 10 April 2024 also refused an earlier Xtreme Scaffolding application (OC2069289) and recorded that XP’s licence (OC2008565) was ultimately revoked on 2 April 2024.

For creditors, the figures matter. With HMRC listed at £52,787 and taxpayer‑backed lending in the mix, any transfer of vehicles or work from XP to the newco should be documented, valued at market rates, and disclosed in the liquidation file. The decision does not identify the liquidator, but it references a liquidator’s report summarising the shortfall.

Training alone will not rescue a weak record. Although both directors completed Operator Licence Awareness Training in May 2025, the Commissioner said it did not outweigh the adverse findings. Any future bid, officials stress, must be supported by evidence of working systems, financial standing, and professional competence-not promises.