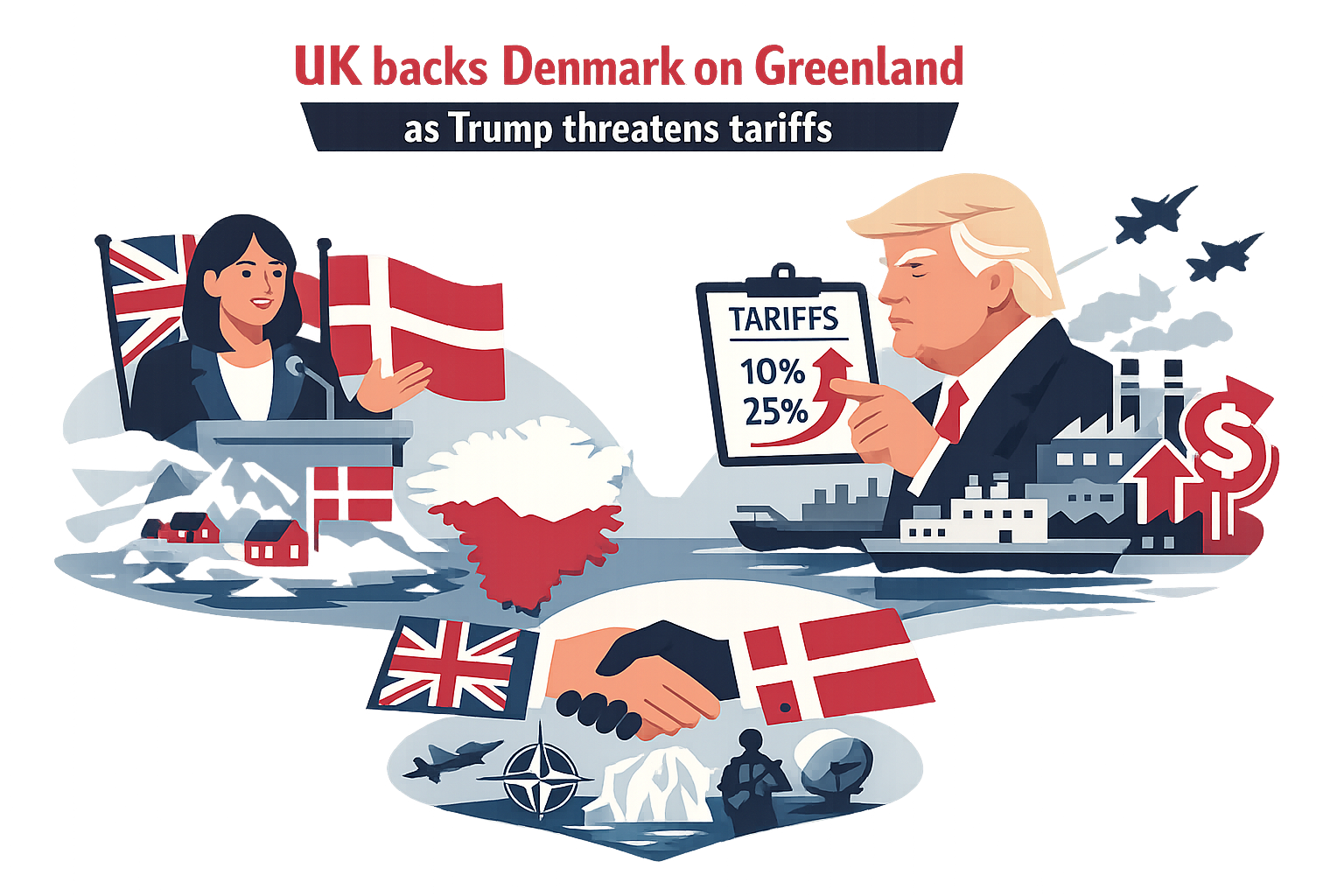

Lisa Nandy said the government will not compromise on Greenland’s status, calling the UK position “non‑negotiable” and rejecting Washington’s tariff gambit. She told broadcasters the island’s future is for Greenlanders and the Kingdom of Denmark to decide, not a bargaining chip for trade threats. Sky News carried her remarks on Sunday 18 January. (news.sky.com)

On Saturday 17 January, President Donald Trump announced a 10% tariff on all goods from the UK and seven European allies starting 1 February 2026, rising to 25% on 1 June unless those nations agree to a US purchase of Greenland. The eight capitals replied with a joint statement warning the plan “undermines transatlantic relations” and risks a “dangerous downward spiral,” and said they stand in “full solidarity with the Kingdom of Denmark and the people of Greenland.” (washingtonpost.com)

Prime Minister Keir Starmer condemned the move as “completely wrong” and said the UK would pursue the matter directly with the US administration. His statement reiterated that Greenland is part of the Danish realm and its future is a matter for the Greenlandic people and Denmark. (theguardian.com)

Washington’s threat is tied to NATO activity in the Arctic. European troops and planners have been rotating through a Danish‑led exercise dubbed Operation Arctic Endurance; the eight governments stress the drills “pose no threat.” Downing Street has also sent a UK military officer to Greenland at Denmark’s request as part of a reconnaissance group. (washingtonpost.com)

For readers concerned with business resilience rather than slogans, a blunt point: US import tariffs are paid to the US government by US importers. Costs are often pushed back through supply chains, forcing UK exporters to discount or lose orders. That is where cashflows crack first. (cfr.org)

If Trump’s 10% duty lands on 1 February, followed by 25% from 1 June, UK firms exposed to US sales will face immediate price pressure from buyers, tougher credit terms, and potential cancellations. Lenders and trade credit insurers will mark up risk. Directors already operating on thin margins should be preparing 13‑week cash forecasts, engaging early with creditors, and documenting viability plans to avoid wrongful trading accusations if orders slump. These are not hypotheticals once a duty hits invoices.

There are legal and practical question marks in Washington’s plan. The Associated Press, via the Washington Post, notes uncertainty over how the White House would apply country‑specific tariffs to EU members given the bloc’s single customs territory, and points to ongoing US court battles over emergency tariff powers. None of that changes the near‑term commercial risk to UK exporters if US Customs starts collecting on 1 February. (washingtonpost.com)

Despite hawkish talk from parts of the White House-officials have refused to rule out force-House Speaker Mike Johnson has said he does not foresee “boots on the ground” and that diplomacy is the route. That may calm markets, but it does nothing to resolve the tariff clock now ticking. (wboi.org)

Copenhagen has been explicit: Greenland is not for sale, and any attack on a NATO ally would mean the end of the alliance. Greenland’s leadership likewise says it would rather remain within the Danish realm than be absorbed by the United States. Those lines leave little room for transactional deals. (abcnews.go.com)

For context, the US already operates Pituffik Space Base in north‑west Greenland under a 1951 defence agreement with Denmark, with roughly 150–200 US personnel typically stationed there. The point is not a lack of footprint, but a demand for ownership-a shift that has escalated since the January operation to oust Venezuela’s Nicolás Maduro. (history.com)

Inside Corporate Insolvency view: with less than a fortnight to the 1 February start date, ministers should publish sectoral exposure analysis and the assumptions behind it-by SIC code, export intensity, and working‑capital days-so creditors, suppliers and employees can see who is being put at risk. Anything less leaves directors guessing while the tariff meter runs. If Washington steps back, so much the better; if it doesn’t, the UK’s insolvency courts will be busy by spring.