Companies House is not a courtesy noticeboard; it is the statutory audit trail that allows creditors to follow the money and hold office‑holders to account. In 2025 the rules are clear: if an insolvency practitioner does not put the right documents on the public file, on time, they risk challenge over conduct and fees. What follows is a filing‑by‑filing guide to what must appear for CVLs and MVLs, the deadlines, and the red flags creditors should look for.

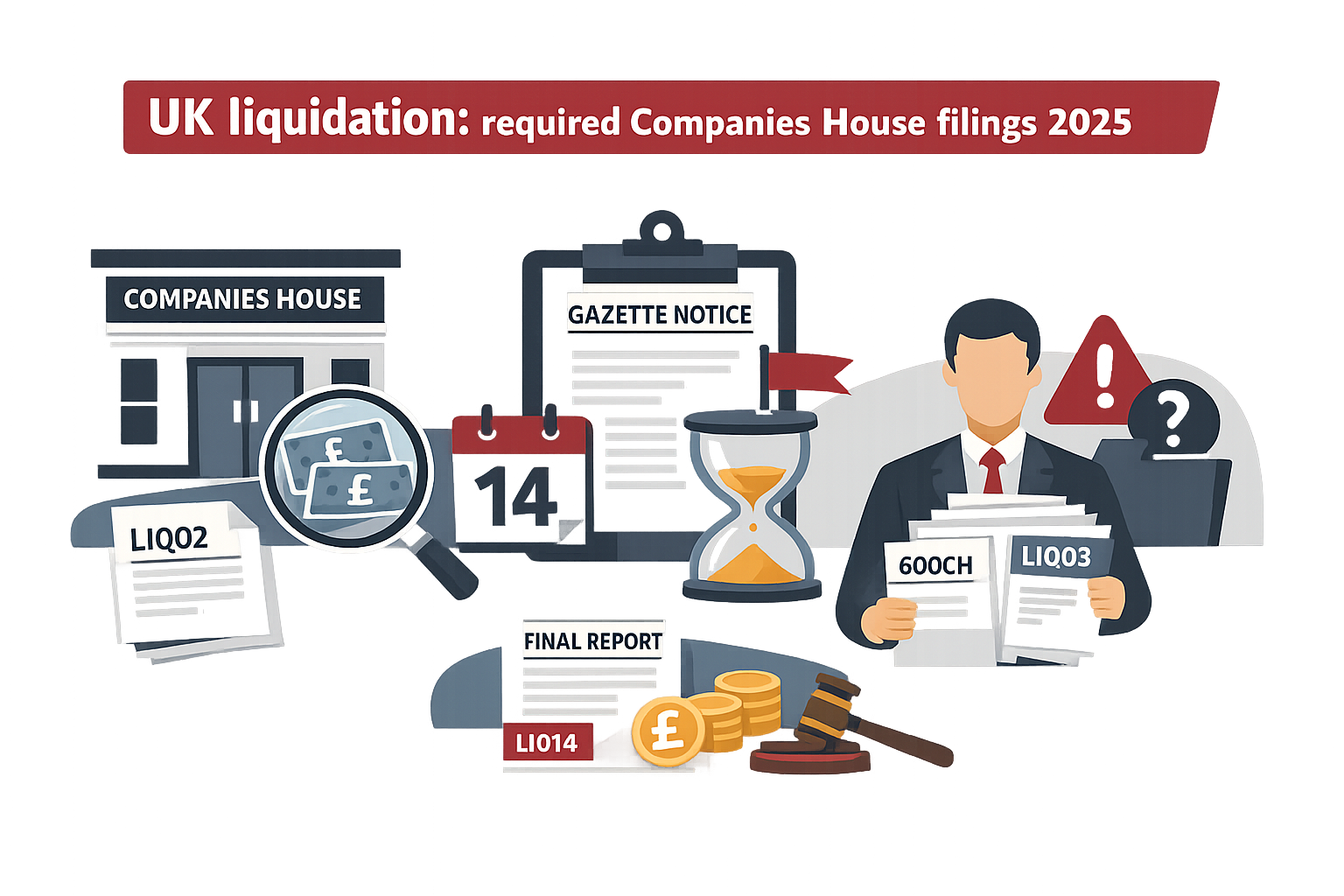

A voluntary liquidation starts with a special resolution. The company must advertise the resolution in the London Gazette within 14 days and deliver a copy of the resolution to Companies House within 15 days. If it is an MVL, the directors’ statutory declaration of solvency sits alongside that corporate act. If these are missing from the record, the story starts off crooked.

Appointment of the liquidator must be notified to Companies House within 14 days and advertised in the Gazette. For England and Wales appointments on or after 9 December 2017 the correct form is 600CH; the Gazette notice is made using 600a. Check the public file shows both the appointment and the Gazette notice; late or missing entries are a routine route to complaint.

If a company moves from administration to CVL, the conversion only bites when Companies House registers form AM22; the liquidator’s appointment must then be filed (via 600CH). Appointments dated before the AM22 registration are invalid. Companies House will not “prioritise” filings and registration, not receipt, is what counts-so paperwork returned for correction delays the legal changeover. A final progress report from the administrator must accompany the AM22.

For a CVL, the statement of affairs must be put on the public record promptly. The liquidator must deliver notice of the statement of affairs to Companies House within five business days after completion of the decision procedure or deemed consent to their appointment, using LIQ02. If disclosure would prejudice the case or risk harm, an order limiting disclosure can be sought; where granted, Companies House should receive the order and the redacted document.

In MVLs, the statutory declaration of solvency must be filed using the updated LIQ01. Companies House warns it will reject obsolete versions following changes brought in alongside the Economic Crime and Corporate Transparency Act-so if the declaration is missing or an old form appears, treat it as a process failure from the outset.

Progress reporting is not optional. Rule 18.7 of the Insolvency Rules 2016 requires a report for each 12‑month period from appointment and for every subsequent 12‑month period, delivered within two months of period end to Companies House (and to creditors in a CVL, members in an MVL). The correct public form is LIQ03. Gaps in the reporting chain are a classic warning sign.

What should a progress report actually contain? Rule 18.3 sets the baseline: identification details, a narrative of progress, a receipts and payments account for the period, remuneration and expenses disclosures, distribution information, what remains to be done, and anything else relevant to creditors. SIP 7 then expects financial information to be presented clearly and consistently. If you cannot tie opening balances to the previous report or see the basis of fees, challenge it.

Closure has changed. Final meetings have been abolished in modern liquidations; instead, the liquidator delivers a final account that complies with rule 18.14. In a CVL, the account goes in using LIQ14; in an MVL, LIQ13. When the final account is registered, dissolution follows three months later unless a court defers the date. Creditors should also see the rule 6.28 notice that explains rights to request information and object to the liquidator’s release during the eight‑week window.

Changes in office must be visible. Resignations are notified using LIQ06 and the resigning liquidator’s release takes effect 21 days after delivery of the resignation notice to the registrar, unless the court orders otherwise. Removals by creditors (LIQ07), by court (LIQ10), loss of qualification (LIQ08) and death (LIQ09) also require prompt filing. If you see a switch of office‑holder, make sure the progress reporting timetable remains unbroken.

The upload service is now the norm. Licensed IPs file PDFs through Companies House’s “Upload a document” portal; most insolvency documents, including all LIQ forms and 600CH, are accepted, and filings are registered with the date of upload if acceptable. Poor scans, missing attachments and sending “covering letters” through the portal are common reasons for rejection. If the public file is quiet, it may be a quality failure rather than inactivity-either is a compliance problem.

Be wary of strike‑off. Companies House will not accept further filings once a company is struck off, even if not yet dissolved. Filing on or near a scheduled strike‑off date is a known risk-there is no “priority line” for insolvency documents-so office‑holders must monitor the register and act early. If the company disappears from the register mid‑process, ask why the filings were allowed to drift.

What IPs often fail to publish on time? The LIQ02 statement of affairs in the first week of a CVL; the first 12‑month LIQ03 progress report within the two‑month window; the Gazette appointment notice; and a compliant final account that actually totals, flags any prescribed‑part distribution and explains unclaimed funds. Each omission chips away at creditor oversight and invites fee challenge.

How to check the core filings. On 600CH, the appointment date must be on or after any AM22 registration in conversion cases, the IP number and service address should appear, and a matching Gazette notice should exist. On LIQ02, expect the correct verification and, if an order limiting disclosure exists, that order should be on file. On LIQ03, tie opening to closing funds, confirm the basis and amount of remuneration against what creditors approved, and look for rule 18.10 disclosures of distributions. On LIQ13/LIQ14, the final account must comply with rule 18.14 and trigger the clock to dissolution.

Your rights if the paperwork is thin. Creditors may request further information about remuneration and expenses within 21 days of receiving a report or final account (rule 18.9), and can apply to court within eight weeks to challenge fees or expenses as excessive or the basis as inappropriate (rule 18.34). Progress reports must also state these rights. If reports are silent or evasive, push back.

If you cannot get traction with the liquidator, escalate. The Insolvency Service’s Complaints Gateway routes conduct concerns to the relevant Recognised Professional Body. Persistent late or missing filings, defective reports and non‑compliance with SIP 7 and SIP 9 are standard grounds. Keep copies of what is on the register and what should have been there.

A final caution on continuity. When companies are restored after dissolution, Companies House may expect a full sequence of 12‑month progress reports with no gaps, even for periods when the company was off the register. Practitioners who think a final account has “closed the book” can find reports rejected unless the sequence is complete-creditors should watch for retrospective backfilling that obscures scrutiny.