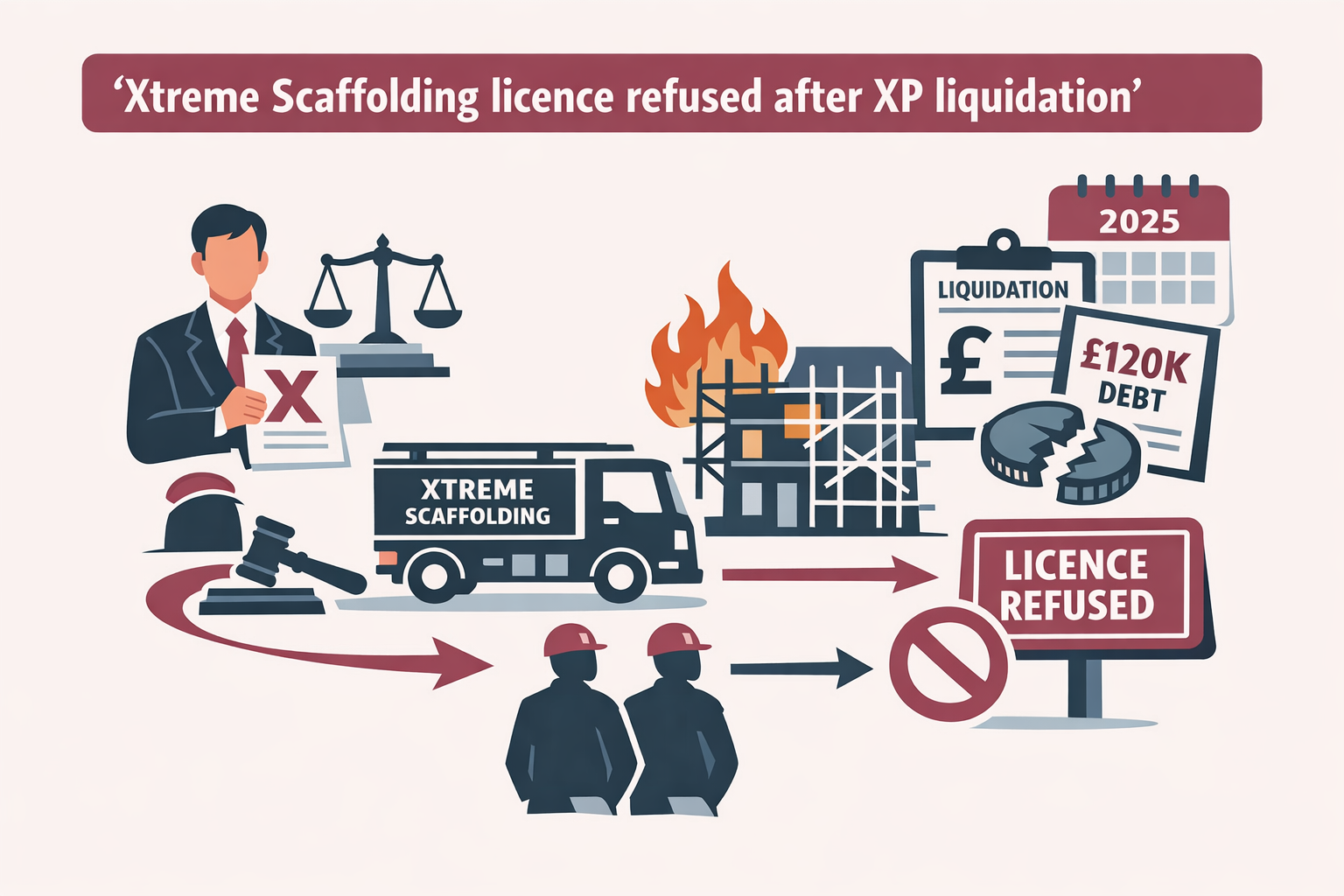

Traffic Commissioner David Mullan has refused Xtreme Scaffolding Services Ltd’s latest bid for a restricted operator’s licence (OC2081807) after a public inquiry in Golborne on 22 October 2025. The written decision, dated 27 October and published on 6 November, records failures on fitness (section 13B), compliance (13C) and financial resources (13D) for an application covering one vehicle.

Why this matters to creditors: the Commissioner links the applicant to XP Scaffolding Ltd, which entered liquidation on 5 October 2023. He had already revoked XP’s operator’s licence on 2 April 2024 and cites a liquidator’s report showing £120,743 owed, including £52,787 to HMRC and a £45,000 Bounce Back Loan.

The Gazette names Clive Morris (IP 8820) of Marshall Peters as liquidator of XP Scaffolding Ltd, appointed on 5 October 2023. That appointment tallies with the sums relied on in the regulatory record. Creditors will want the liquidator’s report and asset schedule to be tested against any transfers to Xtreme Scaffolding Services Ltd.

Both XP vehicles were purchased by the new company. In the 2024 hearing on XSS’s first application (OC2069289), the Deputy Traffic Commissioner described that bid as a “phoenix application” aimed at continuing XP’s operations without its liabilities. That backdrop was squarely in play at the 2025 refusal.

Engagement with the regulator was absent. Calling‑in letters went out on 26 August 2025; Royal Mail tracking shows delivery on 29 August, signed “Proctor”. No case‑management directions were met and XSS did not attend the 22 October hearing.

Mullan declined to adjourn, noting a full diary until January 2026 and, more importantly, no sign the applicant was actively pursuing the case. The official notice summarised the point: the burden sits with the applicant, and here it was not discharged.

Money for safe maintenance was not proven. The decision points to the Senior Traffic Commissioner’s guidance that restricted‑licence applicants must evidence access to funds-£3,100 for the first vehicle and £1,700 for each additional vehicle. XSS filed nothing current to show adequate finance.

Compliance concerns were not academic. The decision refers to potential false statements about vehicle use, ANPR hits for vehicles said to be off‑fleet, and evidence of one vehicle operating without a valid MOT. DVSA had already logged 241 ANPR sightings of XP’s former truck GF62 NHO after liquidation.

The directors’ previous conduct also counted. An earlier company of the same name (company 06280968) was dissolved in March 2021, yet its licence was left to lapse by non‑payment in August 2022-and the dissolution was never reported to the regulator, breaching a basic duty of candour.

XP’s licence history raised further questions. It was granted at public inquiry in April 2018 with Stephen Procter as sole director; immediately after, David Barson was added as director on the very day of grant, a link not declared at the hearing. That licence was ultimately revoked on 2 April 2024.

Both directors completed Operator Licence Awareness Training in May 2025. The Commissioner acknowledged this but concluded training alone did not outweigh the negative features or rebuild trust that the business would comply in future.

The practical outcome is that XSS remains without an operator’s licence. Any fresh application must show credible systems, verifiable financial standing and competent control of vehicles. For XP’s creditors-including HMRC-this decision offers a rare view of the asset trail and the regulator’s assessment of a “phoenix” move.